Retail Sales Tax VS Consumer Use Tax VS Vendor Use Tax

Described below the difference between retail sales tax, vendor use tax and consumer use tax in the state of Missouri.

What is Missouri Retail Sales Tax?

Missouri retail sales tax is applied if any person or company fabricating sales of tangible personal properties or services such as buying a taxable equipment or performing taxable services within the state of Missouri.

The current sales tax rate of Missouri is 4.225%. It is advised to visit Missouri Department of Revenue website for the latest sales and use tax rate prior to charge to a buyer. Sales tax calculator is used to compute sales tax Missouri.

What is Missouri consumer use tax?

Unlike sales tax which is imposed on the retail sale in Missouri on out of state purchases, storage, or consumes tangible personal property in the state of Missouri. Use tax is not applicable if a purchase is made through a Missouri retailer.

The purchaser is responsible for remitting the use tax in the state of Missouri if out-of- state use tax is not collected by the seller.

A vendor and its affiliates such as out of state drop shippers who are selling tangible personal property to the customers and do not have a nexus and presence in the state of Missouri pay use tax to their states department of revenue directly not to the Missouri department of revenue.

What is Vendor Use Tax?

A vendor use tax is charged to those out of state buyers who also have nexus and presence in the state of Missouri. Under this illustration sales tax is paid to the Missouri department of revenue.

Who requires a sales tax license in Missouri?

Following conditions determine if a vendor needs to apply for a sales tax license in the state of Missouri or not:

-

Tangible personal property sellers having sales tax nexus in the state of Missouri full or part requires registration for a sales tax permit.

-

A person or company is delivering taxable items to the state of Missouri customers within MO obtains sales tax license Missouri.

-

An out of state vendor does not acquire a sales tax, license, Missouri if the vendor does not have an existence and nexus in the state of Missouri.

-

Sufficient nexus is determined by the Missouri state such as an out of state vendor has a physical location and influence on salesperson, contractor, location or a number of different events. It should be consulted with the Missouri department of revenue representative and an attorney.

-

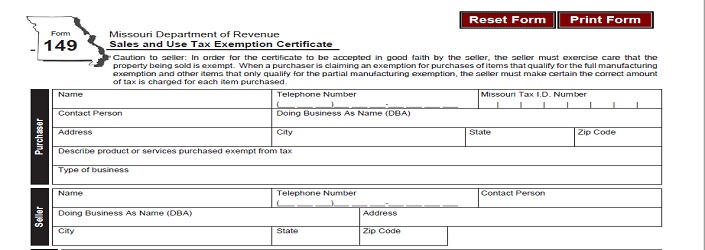

A person or company who is engaged in 100% wholesale activities does not acquire a sales tax, license and form 149 Sales/Use Tax Exemption Certificate is provided to a vendor for purchases.

What is the process of registration for a sales tax permit in Missouri?

The registration process is online at the Missouri Department of Revenue. Fill out the Missouri Tax Registration Application (Form No 2643) electronically. A penalty is imposed on the taxpayers who sells taxable items without obtaining retail sales tax license which is $500.00 for the first day and $100.00 subsequently for each day. The maximum penalty is $10,000.00

How much does it cost to obtain a sales tax permit in Missouri?

Department of revenue Missouri does not charge any fee to issue a retail sales tax, license instead there is a surety bond requirement exists which is described below.

A business, maintaining retail sales must post a bond equal to two times their average monthly sales or use tax liability. The other business registration fees may apply. A surety bond is obtained from any insurance company.

A sales and use tax bond calculator is used to compute the bond amount which is accompanied along with the sales tax application to the Missouri department of revenue.

How long does state of Missouri take to issue a sales tax license?

Missouri department of revenue issues sales tax, license after receiving a surety bond. The entire process to issue a sales tax license is two to three weeks from the date sales tax license application was submitted to the MO department of revenue.

Is state of Missouri Sales Tax License renewable?

No, sales and use tax license, Missouri is not renewable.

What are the taxable services in the state of Missouri?

The current taxable services in Missouri are but not limited to:

-

Place of athletic events, amusements, and recreation

-

Domestic utilities

-

Telecommunication services

-

Telegraph companies

-

Service labor

-

Interstate tickets

What are the sales/use tax exemptions and exclusions?

Exemptions: Exemptions are the particular provisions eliminating the tax due on an item subject to tax. Exemptions are legislative decisions those are carried in certain instances.

Exclusions: the items come under exclusions are those which are never subject to tax due to the intended scope and authority of Missouri’s Sales and Use Tax laws.

What is Missouri State Vendor sales/use tax compliance?

A vendor and its affiliates who are selling tangible personal property to the Missouri customers should pay and collect sales or use tax if they want to be eligible to obtain a Missouri state contracts. If you are not properly licensed to collect, use/sales tax, your bid does not comply with Section 34.040.6 RSMo, and you will be not awarded by any contract by the state of Missouri.

What is vendor no tax due certificate?

The state of Missouri provides you a vendor no tax due certificate if you do not provide taxable services or sell tangible personal property at retail. The letter verifies that there is no need of registration for sales/use tax because you are not going to make taxable sales in Missouri.

How to obtain a Vendor No Tax Due?

When a business is properly registered and has paid its all sales/use tax, the Missouri Department of Revenue issues Vendor No Tax Due.

What are the due dates for filing the sales tax returns in the state of Missouri?

-

The monthly returns are due by the 20th of the current month.

-

The quarterly returns are due before the last day of the month.

-

Annually returns are due before January 31.

-

Detailed guidelines are published about the frequency of sale and use tax returns on the Missouri department of revenue website.

-

A taxpayer still files sales tax return with no sales tax due if business is generating any revenue yet.

How to find sales tax license revocations?

A failure to remit income taxes may cause to sales tax revocations. A business with revoked sales tax license can be search by:

-

County

-

City

-

Sales Tax License Number

How to apply for credit or a refund of sales or use tax?

One must fill the seller’s claim for use or Sales Tax Refund or Credit and will submit the amended sales tax returns along with supporting documentation.

How to apply for a refund of Use or Sales Tax?

One must fill the purchaser’s claim Section 144.190.4(2) along with supporting documentation.