What is a Sales and Use Tax License Minnesota?

A state of MN business owner who is engaged selling taxable products and services in the state of Minnesota is required to collect sales tax from a Minnesota buyer for the Minnesota department of revenue. Sales tax permit is used to collect sales tax, whereas, the use tax is collected on the out of state purchases or if the sales tax was not paid on the taxable goods to the MN seller.

How to apply sales and use tax Minnesota?

Sales tax is applied by the seller on the taxable products or services sold to use in the state of Minnesota, where as, Use tax is charged on the taxable items bought without paying a sales tax and it is paid by a purchaser directly to the Minnesota Department of Revenue.

How to collect sales and use tax from a buyer?

A Minnesota department of revenue has designated a vendor to collect sales tax from a buyer on the behalf of the Minnesota department of revenue.

It is collected on gross receipts, including shipping and handling charges. Gross receipts are comprised of Taxable and nontaxable sale amount, Lease and rental of real property or taxable tangible property.

State of Minnesota taxable and non taxable items:

The updated list of the taxable and non-taxable items is published on the Minnesota department of revenue website.

Tangible personal properties are sold in the state of Minnesota are taxable such as perfumes, computers, office supplies, etc. unless qualified for an exemption by the Minnesota Department of Revenue.

Legal and cleaning services are deemed non-taxable unless enumerated taxable by the Minnesota Department of Revenue.

Digital services which are included digital audio works, digital audiovisual works, digital books, electronic greeting cards and online or electronic games are described subject to sales tax by the MN Department of revenue unless identified taxable by the MN Department of Revenue.

Real Property including buildings and home improvement are deemed non-taxable by the Minnesota department of Revenue.

Intangible property which includes stock certificates is a nontaxable item.

How to Register Sales and Use Tax Permit Minnesota?

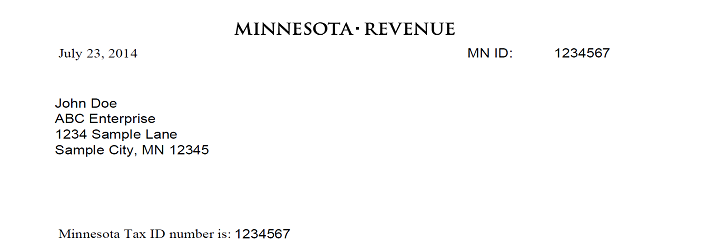

Sales tax permit is issued by the state of Minnesota. It is applied online and generally the state issues sales tax permit same day. State tax ID Minnesota department of revenue website.

How to calculate sales tax Minnesota?

The sales tax on taxable good and services is calculated based on the following sources:

-

Sourcing Rules for Leases or Rentals of Tangible Personal Property

-

Sourcing Rules for direct mail

-

Miscellaneous Sourcing Rules

-

Multiple Points of Use Sourcing

-

Is the sale sourced to Minnesota?

-

What is included in the sales price?

-

What is included in the sales price?

-

What is not included in the sales price?

-

Which services are taxable in Minnesota?

-

Which digital products are taxable in Minnesota?

-

What is tangible personal property?

-

Prewritten Computer Software and Software Maintenance Agreements

-

How do we define different types of labor?

-

Optional maintenance and extended warranty contracts

Sales tax impacts on sales made over the internet:

Sales tax is charged in the state of Minnesota on the taxable sales whether the sales was occurred online or from the store-front. The same rules apply in either case of the MN department of revenue.

Sales Tax Calculator:

The Minnesota Department of Revenue website provides a sales tax calculator to compute sales and use tax correctly as per the jurisdiction.

Minnesota Sales and Use Tax Filing Frequencies:

MN department of revenue set up your filing frequencies based on your previous year sales tax collection activities. It can be monthly, quarterly or annually.

-

Filing Annually, if annual tax reported is less than $100.0 per month, the due date will be February of the following year.

-

Filing Quarterly, if annual tax reported is less than $500.0 per month, the due date will be 20th day of the month after the end of the quarter.

-

Filing Monthly, if annual tax reported is More than $500.0 per month, the due date will be 20th day of the month after the end of the month.

The Minnesota Sales Tax Permit Revocation:

-

Sale and use tax license will be terminated by the MN Department of Revenue and impose penalties if do not follow the sales and use tax guidelines which are stated by the Department of Revenue Minnesota.

-

MN sales tax permit can also be revoked, if the owner of the business owes $500.00.

-

All prior dues are paid to reinstatement the sales tax permit Minnesota.