What is Sales Tax in Tennessee?

A person or business is engaged selling taxable product and services are required to obtain a sales tax for the state of Tennessee. Generally a sales tax is imposed on the following items or services.

- Retail sales leases, or rentals in Tennessee of any goods, computer software, warranty contracts, or certain services and amusements

What is Use Tax in Tennessee?

An individual or business must register and report for use tax on the purchases bought either from out of state or local without paying tax. The purpose of the use tax is not imposing an additional tax on the tax payer's shoulder, but also to protect local merchants, who must collect the sales tax, from unfair competition from out-of-state sellers who do not collect Tennessee's sales tax. The 45 states that impose a sales tax also levy a use tax.

Note:If the seller adds the sales tax in the price or you have paid sales tax on purchases items, then you are not required to pay a consumer tax.

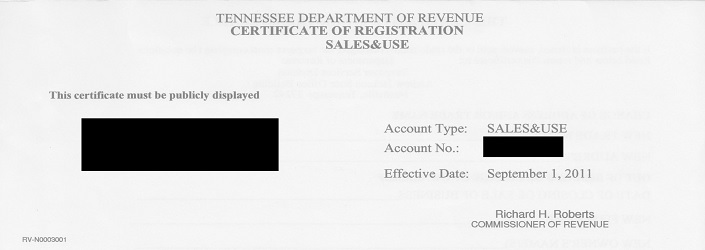

How to apply for Tennessee sales and use tax?

You can apply for the sales tax, registration online with the TN department of revenue. State usually takes 5-7 working days to issue you a sales tax number.

Look up Tennessee sales tax number

Vendors can check online with the TN Department of Revenue website, to verify Sales and Use Tax Resale and Exemption Certificates.

What are the due dates to file sales tax returns?

- Monthly - 20th day of the month following the end of the reporting period

- Quarterly - 20th of the month following the end of the quarter (January 20, April 20, July 20, October 20)

- Annually - January 20

- You can check the tax rates on the TN Department of revenue.

- Sales and Use Tax returns must be submitted electronically

Obligation of the Sales and Use Tax Holder

- Post sales and use tax certificate at the business place.

- All information on the certificate must be current including business address.

- Collect and File sales tax according to the tax chart and on or before the due dates to avoid potential enforced collection action.

- Each location must have a separate certificate

- Sales tax number or certificate is not transferable