What is Alabama Sales Tax?

The tax imposed on the sale of tangible personal property or goods by retail sellers to end consumers or those persons who do not buy for resale purpose. These registered retail sellers collect sales tax from their customers on behalf of the Alabama state along with the price of selling goods for further payment to Alabama State. It is taxed on the end user or a consumer and withholding for a seller to pay back to the Alabama Department of revenue.

Sales and use tax rate list is viewed on the Alabama Department of Revenue website.

Local Sales tax in Alabama: Despite Alabama State sales tax every city and county in Alabama state has a local sales tax for the retailers. Contact with the relevant office for more details.

What is Alabama Use Tax?

A tax imposed on the sale of personal property or goods or services by a business locating outside the State. It has two types

-

Seller Use tax

-

Consumer Use tax

What is Alabama Sellers Use Tax?

The tax imposed on the sale of tangible personal property or goods in Alabama State by a business located outside of Alabama State. Provided that such sellers have no inventory in Alabama State and made a sale via its sales offices, agents, or by any significant recurring contact or "nexus" with Alabama. The reporting responsibility lies with the retail vendor to charge, collect and remit to Alabama State if it has “nexus” in Alabama. And a retail vendor has “nexus” in Alabama if they have a physical presence in Alabama.

What is Alabama Consumers Use Tax?

If the retail vendor (Non-resident of Alabama) has no “nexus” in Alabama then the reporting responsibility should pass to the consumer. And they will self-assess the use tax liability and pay to the Alabama Department of Revenue.

Who must apply for Sales Tax Number Alabama?

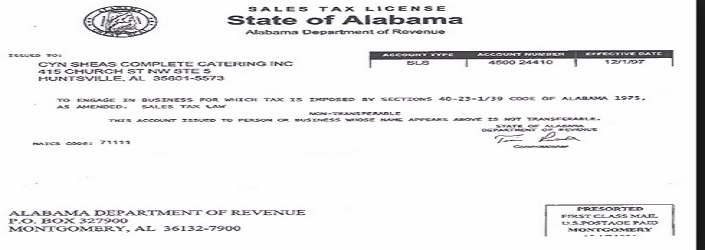

You must register with the Alabama Department of Revenue if you conduct business in Alabama, or with Alabama customers.Obtain a tax account number from the Alabama Department of Revenue if sell any taxable products and services. Retailer sellers of tangible personal property are required to register for an Alabama sales tax license.

How to register or obtain for Sales and Use tax number in Alabama?

It is very easy to get your business registered with Alabama department of revenue or obtain a sale and Use tax number from Alabama Department of revenue (ADOR). You may register via online at official website of ADOR or through the mail by filling completed form (COM: 101) but federal taxpayer identification is mandatory for registration with ADOR.

Are wholesalers required to obtain sale tax number?

No, wholesalers are not required to obtain sale tax number, however, they have to check with attorney or Alabama department of revenue for other registrations if necessary.

Filling period of sale tax returns

Every registered person has to file monthly, quarterly and annually return before the due date to avoid penalties. There is no exemption for filling either sale was made or not.

How to file sale tax return in Alabama?

All business taxpayers have to file sale tax return electronically by using “My Alabama Taxes (MAT)” online web based application. And ADOR has no fee for filing return electronically.

How to pay sale tax to ADOR?

Effective from October 1, 2016, ADOR requires paying through electronically fund transfer (EFT) for every payment greater than or equal to 750 USD.

How to amend sale tax return?

If you found any error in your filled sale tax return then you may amend it by paying the additional tax, penalty, and interest due by requesting to the ADOR. You may amend electronically or physically by filling the new amended form with the ADOR.

Is sale tax applicable on goods sold via online store?

Yes, all goods sold via online store is taxable in Alabama and regular rate of sale tax and use tax will be charged according to nature or transaction.

What is sale tax holiday; does ADOR have sale tax holidays?

A subsidy or withdraw or reduction or temporarily elimination of sale tax called sale tax holiday. Alabama State has two sale tax holidays

-

Back-To-School (beginning at 12:01 a.m. on the first Friday in August, and ending at twelve midnight on the following Sunday).

-

Severe Weather Preparedness (beginning at 12:01 a.m. on Friday of the last full weekend in February and ending at twelve midnight on the following Sunday).

Are religious and charitable nonprofit entities are exempt from sale and use tax?

No, all nonprofit entities are not exempt from sale and use tax. Some nonprofit entities are exempt from sale and use tax by special acts passed by the legislative bodies.

What items are exempted from sale tax in Alabama?

Prescription drugs, gasoline and motor oil (kerosene and fuel oil are taxable), fertilizer/insecticides/fungicides when used for agricultural purposes, seeds for planting purposes, feed for livestock and poultry (not including prepared food for dogs and cats), baby chicks and poults, livestock, sales to the U.S., State of Alabama and other governmental agencies of the State of Alabama, labor to repair or install property is exempt as long as it is billed as a separate item on the customer's invoice (labor to fabricate an item is not exempt).

Note: cigarettes and beer are not exempt from sales or use tax.

What are the exempted organizations from sale and use tax in Alabama?

Sales made directly to the federal government, the State of Alabama and counties and cities within the State; sales made directly to Schools (not daycares) within the State; sales made to City and County owned and operated hospitals and nursing homes; sales made to some non-profit agencies that have been specifically exempted by the Alabama Legislature - examples include but are not limited to Alabama Sheriffs Boys Ranch, Boy Scouts & Girl Scouts of America.

Note: Not all non-profit organizations are exempt.

How to apply for a Alabama Sales and Use Tax?

You will provide the following information to Obtain a alabama Sales Tax Number from the Alabama Department of Revenue.

Name of the business or your legal name

-

Business description

-

Business address PO Box is not acceptable

-

All owners' information, including name, address, social security number (not applicable for non US resident) and date of birth

-

Ownership percentage if more than one owner

-

Employer identification number if incorporated as a Corporation or an LLC

-

Estimated monthly gross sales

-

The state may reject your application, if you owe sales tax to any of your prior business

-

You can request to the state for a duplicate copy, if you have lost your sales tax certificate

-

You will surrender the sales tax certificate and notify the state if planning to close the business

-

Purpose to Register Sales Tax Permit in Alabama

-

Processing time- Alabama department of revenue usually issues sale and use tax license in 2-3 business days.

-

State of Alabama usually takes 3-5 working days to issue you a sales and use tax license.