What is Sales and Use Tax Registration Kentucky?

- Sales tax is imposed on the tangible taxable properties and taxable services provided in the state of Kentucky. Sales tax is collected from the customers.

- Use tax is usually imposed on the purchases made without paying a sales tax for out of state vendors and storage or use items. It usually pays directly from the buyers to the Kentucky department of revenue. Property which is purchased, leased or rented outside of

Kentucky for storage, use or other consumption in this state is subject to the use tax.

Every business owner is required to register for sales and use tax with the Department of Revenue, Kentucky to make taxable sales and provide taxable services is defined by the Department of Revenue Kentucky.

How to apply for a Sales Tax Number Kentucky?

- You can either apply sales tax registration online at the Kentucky Department of Website or fill out a form 10A100).

- Kentucky Department of Revenue usually takes 1-2 business days to process your application.

- Local sales and use taxes are not applicable in the state of Kentucky.

Sales and Use tax reporting requirement

- You cannot charge sales and use tax without obtaining a sales tax number from the Department of Revenue.

- You can look up a sales tax rate table at the Kentucky Department of Revenue Website to charge your customers.

- The out-of-state retailer has to issue you a complete Kentucky resale certificate with his state’s retail number and disclose a statement on the certificate that he is an out-of-state retailer not required to hold a Kentucky permit.

- Sales tax is calculated on the gross receipts, including shipping and handling charges.

- The use tax is calculated on the purchase price of the merchandise.

- You should keep the record at least four years to share the KY Department of revenue, in case of an audit or review of your sales tax activities by the KY Department of revenue.

- You have to submit Form 51A205 to the KY Department of revenue, if you intend to close your sales tax account.

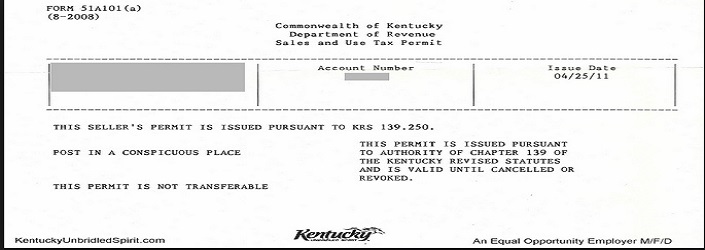

- You should post the seller's permit Kentucky on the business location as long as your business is active.

Sales Tax Returns Filings Due Dates

The Kentucky Department of Revenue requires all sales tax filing to be submitted by the 20th of the following month, and the tax return must be completed the next working day, if the date falls on the holiday.

Sample:

Sales Tax Collected from the customers in the month of January, must be paid to the KY Department of Revenue by February 20th. If the due day falls on Saturday, Sunday or a holiday then the taxes must be filed the first working day after the holiday.