What is a New York Sales Tax?

Every person or a legal entity which is registered with the secretary of state or division of corporations and engaged selling taxable tangible products and services is required to register for a sales tax registration with the New York State Division of Taxation and Finance regardless the sell was originally initiated from home or internet.

The most current and updated list of the taxable and nontaxable items is published on the New York State Division of Taxation and Finance which is referred to calculate accurate sales tax on taxable items.

How to calculate sales tax in New York state of taxable items?

Sales and use tax in the state of New York is calculated based on the city and county where sales have taken place. A sales tax calculator is used to calculate accurate sales tax on taxable goods and services.

What is a Use Tax in New York?

A use tax is paid on taxable products and services which are either bought from out of state vendor, used personally and kept for the storage purpose and seller did not collect sales tax.

How to apply for a New York Sales Tax Certificate of Authority?

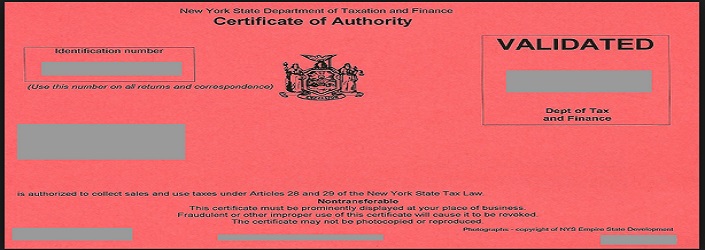

It is applied electronically by filing a Form DTF.17 with the New York State division of taxation and finance. New York state normally issues a sales tax certificate of authority within a week unless there is a flaw in the sales tax application and need additional information before allows an authority to a New York vendor to sell taxable items to buyers.

What information is required to get a sales tax certificate of authority?

-

Name of the person or company applying for the sales tax certificate of authority.

-

Details of each owner and responsible parties which includes complete name, social security number, date of birth and residence address.

-

Employer Identification Number (if applicable). It is required for all the legal entities other than sole proprietorship business.

-

Business description with the industry code.

-

Business street address (PO Box is not acceptable)

-

Expected business starting date

-

Estimated gross taxable income which is used to set up the sales tax reporting deadline such as a monthly, quarterly or a yearly filer.

-

Bank account information is provided if available.

-

Tax Preparer information is provided if available.

Does sales Tax Certificate of Authority New York renew every year?

In most cases it is renewed yearly, but the NYS division of taxation sends a notification to renew sales tax certificate of authority if it applies. New York State charges $50.00 to renew sales tax certificate of authority and generally it is renewed every year.

What is the penalty to sell taxable goods and services without a sales tax certificate of authority?

The New York State imposes penalties up to $10,000.00 for failing to file a sales tax certificate of authority.

Sales tax certificate of authority displays prominently and failing to display on location is subject to a $50.00 penalty.

A duplicate sales tax certificate of authority is requested to the NYS division of taxation and finance if it was lost or damaged.

An additional DTF.17 is filed to get an additional sales tax permit for multiple location.

What is the difference between a regular and temporary sales tax certificate of authority?

A regular sales tax certificate of authority is obtained to do business perpetually or it ends up at business owners' will not automate, whereas a temporary sales tax certificate of authority is applied to use for no more than two consecutive sales tax quarters in any 12-month period.

How to cancel Sales Tax Certificate of Authority New York?

A final sales and use tax return is filed with the original sales tax certificate of authority to the New York division of taxation and finance. The sales tax certificate of authority is sent back with the signature and the reason to return. Sales tax due is paid with the final sales tax return.

Is Sales Tax Certificate New York Transferable?

The sales tax certificate is not transferable to a new owner of the business and a new DTF.17 is filed to get a new sales tax permit from the NYS division of taxation and finance.

New York State Sales and Use Tax Filing Dates:

Generally following dates are followed to file sales tax returns unless there is a special relaxation is granted by the New York Division of Taxation and Finance.

Revenue collected between March 1 - May 31 is reported on or before June 20th unless there is a holiday which pushes the original date forward.

Revenue collected between June 1 - August 31 is reported on or before September 20th unless there is a holiday which pushes the original date forward.

Revenue collected between September 1 - November 30 is reported on or before December 20th unless there is a holiday which pushes the original date forward.

Revenue collected between December 1 - February 28 (29) is due on March 20th unless there is a holiday which pushes the original date forward.

A sales tax return is mandatory to file on or before the due date whether the business was in operation or not.

Late sales tax return filing penalty is $50.00 and accrued interest is also imposed on late filings. All sales tax returns are required to file electronically otherwise there is an additional penalty applied.

Record Keeping & Bookkeeping for sales tax:

An effective record keeping and bookkeeping is vital to present to a New York State auditor and defend any challenge if it is raised by an auditor of the New York State.

A retailer who sells taxable items in the state of New York is personally obligated to pay any deficiency in sales tax collection regardless sale tax was collected or not by a purchaser.

Open a separate bank account to deposit sales tax withholding?

The New York state division of taxation encourages to maintain a separate bank account for the sales tax. A separate bank account for the sales tax provides following privileges.

- Utilize the bank account to deposit collected sales and use tax on behalf of the New York State division of taxation and finance.

- Deposit every week collected sales and use tax in the segregated bank account. This segregated bank account is also called a sales tax account.