What is Virginia sales and use tax permit?

A sales and use tax permit Virginia is used to sell taxable products and services within the state of Virginia.

Who issues sales and use tax permit in Virginia?

The Virginia Tax Department issues a sales and use tax permit to start selling taxable items and products within the state of Virginia.

Who acquires a sales and use tax permit Virginia?

Every business owner who is involved in selling taxable products and services in the state of Virginia is required to obtain a sales and use tax permit.

The Virginia tax department requires to a business which is involved in the "sales, lease or rental" of personal property as well as taxable services are needed to apply for a Sales and Use Tax Permit prior to start operating a business in Virginia.

This sales permit allows businesses to collect state of Virginia sales tax, local sales taxes and special reduced sales taxes on eligible food items.

Businesses with a taxable existence within the state of Virginia possessed a sales tax nexus.

What are the taxable and non taxable items in Virginia?

The updated list of taxable and non-taxable items are checked at the Virginia Tax website.

Generally, sales and use tax in the state of Virginia is applied on the following products and services;

-

The rental, lease, or sale of tangible personal property

-

The use of tangible personal property in the state of Virginia

-

Taxable services in the state of Virginia

What is the filing requirement to get sales and use tax Virginia?

Following information is supplied to the Virginia Tax Department to file sales and use tax application:

-

Reasons for filing sales and use tax application in Virginia.

-

Business entity name Virginia and revoked and the admin dissolved entities with the Virginia secretary of state are not eligible to file sales and use tax application.

-

The employer identification number is required to mention in the sales and use tax application Virginia, if it is applied under a company name which is either registered with a county clerk Virginia or the Virginia Secretary of State.

-

The social security number is required to disclose in the application for the US-Residents otherwise status is disclosed to by-pass the Virginia State requirement provide the social security number.

-

The entity type is mentioned, such as a corporation or a limited liability company to apply the sales and use tax under a company name.

-

Trade name is mentioned if applicable.

-

Complete business and home address are mentioned to obtain sales and use tax license Virginia.

-

The first date of retail taxable sales is mentioned in the state of Virginia.

How to apply for sales and use tax permit Virginia?

The sales and use tax is applied online on the Virginia Tax Department web-site.

What is the filing fee to secure a sales and use tax permit in Virginia?

The state of Virginia does not charge any fee to issue a sales and use tax license.

What is the state of Virginia processing time to issue a sales and use tax permit Virginia?

The state of Virginia generally issues the sales and use tax license instantly unless there is a deficiency in the application and require to acquire additional information to process the sales and use tax application.

What does Virginia State issue after filing sales and use tax application?

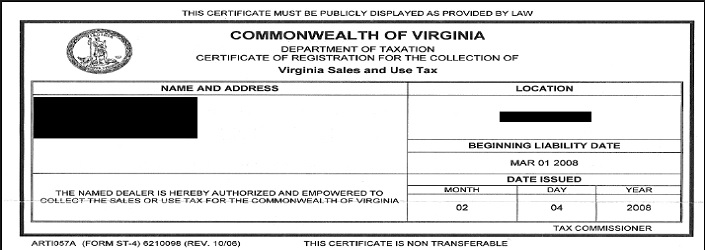

The state of Virginia issues Certificate of Registration (Form ST-4) to display at the business location.

Is sales and use tax permit renewable in the state of Virginia?

The state of Virginia sales and use tax certificate is not renewed unless the state of Virginia asks to do so.

Difference between retail sales and Use Tax:

-

Retail sales tax is collected from the buyer and pays back to the Virginia Department of Taxation.

-

Use tax is paid on the out-of-state purchases. The tax payer generally reports the out of state purchases on the income tax return.

How to file sales tax return in Virginia?

The Virginia Tax Department sends information to the business owners to comply the sales tax filings in order to avoid tax complications. Generally, the following deadlines are following file sales and use tax returns in the state of Virginia.

-

Beginning with the July - September 2013 return, (due October 21, 2013)

-

Quarterly filers of the ST-9 files returns and payments electronically.

-

Monthly filers are filed and pay sales tax Virginia electronically since July 2012.

-

Up to 30% penalty is imposed by the Virginia Tax Department if the sales tax returns were filed late. Additionally, the accrued interest is charged.

-

The Virginia Exemption certificate number is asked for re-sellers.